A managed fund is a type of investment where your money is pooled together with other investors. A fund manager then buys and sells assets, such as cash, shares, bonds and listed property trusts, on your behalf. Managed investment schemes and Corporate Collective Investment Vehicles (CCIVs) are different types of managed funds.

You don't own the underlying investments, you own 'units' in the fund or 'shares' in the CCIV. The value of the units or shares will rise and fall with the value of the underlying assets. Some managed funds also pay income or 'distributions'.

We explain the types of managed funds you can invest in and what to look for to find the best managed fund for you.

Choose the type of managed fund

There are thousands of managed funds to choose from. It's important to understand the different types of funds, the risks and returns so you can choose a fund that meets your needs.

Single asset managed funds

These managed funds invest in a single assets class, such as shares, property or bonds. Here are the main single asset managed funds you can invest in:

|

Type of fund |

What they invest in |

|

Cash funds |

Invests in very low-risk, short-term investments. These can include short-term money market deposits, short-term government bonds and bank bills. |

|

Fixed interest or bond funds |

Generally invest in low-risk loan investments. These can include government bonds, bank bills, or mortgage-backed securities. Some funds invest in corporate bonds or high-yield bonds, which can be higher risk. |

|

Private credit funds |

This refers to funds that loan money to borrowers either directly or via another fund or structure. Mortgage funds and property funds, described below, are a kind of private credit fund. Depending on the quality of the borrowers, purpose of the loans terms of the lending arrangement and whether loans are secured, these can be low, medium or high risk |

|

Mortgage funds |

Invests in property loans (mortgages). Some funds are high risk. The fund's risk depends on the quality of the borrowers and purpose of the loan. You receive income as long as the borrower pays interest. Your investment doesn't increase in value. It can fall in value if borrowers can't repay their loans. |

|

Property funds |

Invests in residential property, commercial property or property developments. Some property funds are high risk. You might not be able to withdraw your money from the fund at short notice. You're not guaranteed a fixed rate of interest or return. |

|

Share (equity) funds |

Invests in listed companies in Australia, overseas or both. These funds offer the potential for higher returns but also have higher risk. |

|

Alternative investment funds |

These include hedge funds and funds that invest in private equity, derivatives and commodities. They can be high risk. You should seek financial advice before you invest. |

Mixed asset or multi-sector managed funds

These funds invest in a range of investments. They're labelled based on the types of investments that make up the majority of the fund portfolio.

|

Investment mix |

Typical characteristics |

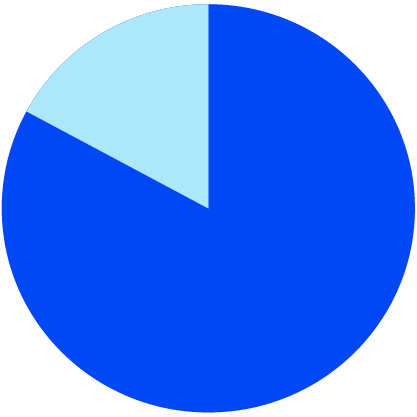

Growth

|

Investment: $10,000 after 10 years = $17,100 (before fees and tax) Expected return*: 5.5% Risk (volatility): High Expect a loss: 5 years in 20 |

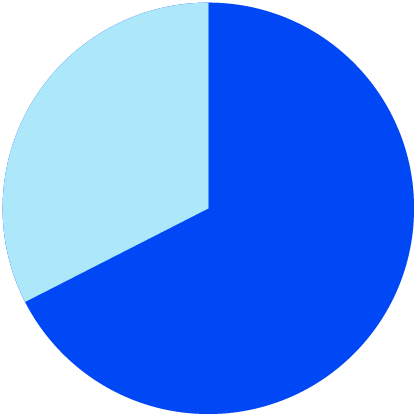

Balanced

|

Investment: $10,000 after 10 years = $16,600 (before fees and tax) Expected return*: 5.2% Risk (volatility): High Expect a loss: 4-5 years in 20 |

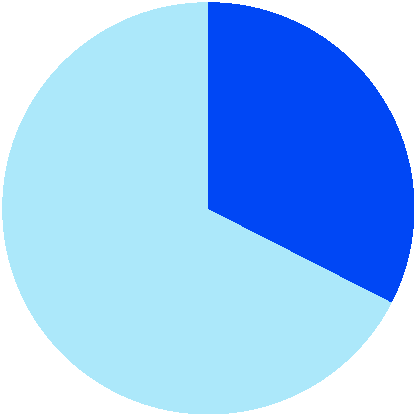

Conservative

|

Investment: $10,000 after 10 years = $15,400 Expected return*: 4.4% Risk (volatility): Medium Expect a loss: 2 years in 20 |

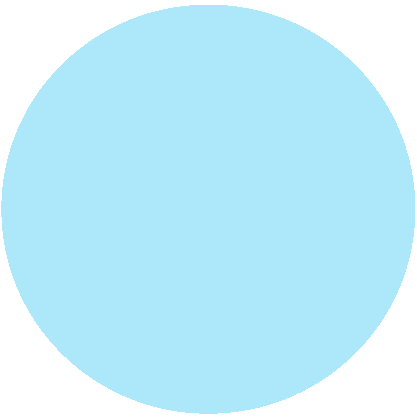

Cash

|

Investment: $10,000 after 10 years = $13,600 (before fees and tax) Expected return*: 3.1% Volatility: Very low Expect a loss: 0 years in 20 |

* These investment returns are based on professional advice received in May 2019. Past performance of a fund is not a reliable indicator of future performance. Returns can vary a lot from year to year. They can be negative in some years, especially where money is invested in higher risk assets, like shares and property.

Compare managed funds

Check the PDS

A product disclosure statement (PDS) contains all the information you need to know about a fund and to compare funds. It includes information on:

- what assets the funds invests in

- the fees

- the risks of investing in the fund

- the benchmark or target return

- how to complain if you have a problem

Look at long-term returns

If a fund performs well in one year, there's no guarantee it will the next year. A fund's performance over 5 to 10 years gives you a better indication of how it will perform in the future.

You should compare the returns of a managed fund or portfolio offered in a managed account against:

- an index fund – to see if it's keeping pace with the relevant market, for example the ASX200

- other similar funds – to see how it's performing against competing funds

You can check how a managed fund has performed by using the Fund Screener on the Morningstar website. You can search for funds based on returns, fees and where they invest.

A managed fund's PDS will tell you the minimum amount of time you should invest for and risk level of the fund. Make sure this lines up with how long you're planning to invest and your risk tolerance.

Review the risks

Each managed fund has different risks based on the assets they invest in. Risk is the likelihood that you'll lose some or all the money you've invested.

You can find information on the risks of investing in a managed fund in the PDS. Some risks to look out for when investing in a managed fund are:

- Funds use different names and labels. For example, 'low risk', 'capital protected' or 'stable'. These may not reflect the risk of the fund.

- Some funds invest in assets that are not liquid. These funds may not be able to redeem units or shares in the fund easily or at the price that is equal to the unit or share price.

- Some funds also don't hold assets directly, they invest in other managed funds.

For more information see understanding investment risk.

Check the managed fund fees

Managed funds charge a range of fees for managing your money. Small differences in fees can have a large impact on your returns.

These are the common fees you should check before you invest.

- Establishment fee – the fee to open your investment. This is usually between 0% and 5% of the amount you invest.

- Contribution fee – the fee on each amount contributed to your investment. It is usually between 0% to 5%.

- Management fees and costs – the fees and costs for managing your investment. It is typically between 0.5% and 2.5% per year. It's deducted from your account balance.

- Performance fee – an extra fee a fund manager may charge if the investment return is better than the benchmark or target return.

- Adviser service fee – ongoing fee paid to your financial adviser for arranging the investment. It's typically between 1 to 2% per year.

The scheme may also charge you fees for transactions, withdrawals, to change investment options or exit the scheme.

Fees reduce the returns of a managed fund. They can also increase in the size of losses as they are charged regardless of whether the fund makes a profit or a loss.

You may be able to negotiate the fees you pay with fund manager or your adviser.

Use our Managed fund fee calculator

Use the managed funds fee calculator to see the impact of fees on your returns.

Buying units or shares in a managed fund

When you invest in a managed fund you are buying 'units' in the managed investment scheme or 'shares' in the CCIV. The number of units or shares you get depends on the unit or share price at the time you invest.

The unit or share price changes depending on the value of the assets the fund invests in. With most managed funds, you'll need a minimum amount to invest, for example $5,000.

Unlisted and listed managed funds and quoted ETFs

- Unlisted managed funds – most managed funds are not listed on an exchange. You buy units or shares in the fund by sending an application form to a fund.

- Listed managed funds – you can buy and sell units or shares in the fund on an exchange, such as the ASX. The unit or share price of a listed managed fund can be higher or lower than the net asset value (NAV) of the fund.

- Quoted exchange traded funds (ETFs) - you can buy and sell units in the ETF on an exchange, such as the ASX's AQUA market or Cboe. The market price of the units in the ETF generally reflects the net asset value (NAV) of the ETF because of the way the ETF is operated.

Withdrawing your money from a managed fund

Managed funds can have fees or restrictions on when you can withdraw your money.

Some funds won't allow you to withdraw your money until a certain point in time. For example, 12 months after your investment.

Other funds may freeze or stop withdrawals to protect all the members’ investments. Stopping withdrawals until the market settles means the fund can avoid selling assets at lower values. Distributions such as income payments might continue from a frozen fund.

You can find information on withdrawal rights in the fund's PDS.

If you're having trouble withdrawing your money beyond the stated fund restrictions, you can complain.

Hardship withdrawals from frozen funds

If your money is in a frozen fund and you're finding it hard to pay your regular bills, you may be able to withdraw some, or all, of your money.

If your fund manager offers hardship withdrawals to all investors, you can apply for a hardship withdrawal if:

- you cannot meet reasonable and immediate living expense

- you are unemployed for at least 3 months and have no other means of financial support (except government assistance)

- you’re applying under compassionate grounds (for example, medical costs for serious illness)

- you have suffered permanent incapacity

If you meet the hardship criteria, the fund manager may approve that you can:

- withdraw up to a total of $100,000 per calendar year, and

- receive up to four withdrawals per calendar year

Your fund manager will let you know whether a fund is frozen. Contact them to apply for a hardship withdrawal.

ASIC provides more information on frozen funds and hardship withdrawals.

Keep track of your managed fund's performance

By law, your fund manager must update you on the fund's performance at least once every 12 months.

Read the performance reports carefully to:

- understand how your investment is performing

- see if it's still helping you to reach your financial goals

Find out more about how to keep track of your investments.